Recently Tokyo Electric Power Company tried to blame the metldown of reactor 1 on an employee turning off the cooling system. Turns out the employee was following TEPCo’s own operating manual!

TEPCo now says the employee was following procedure because coolants temps had actually dropped, so much that their manual called for the shut down of the cooling system.

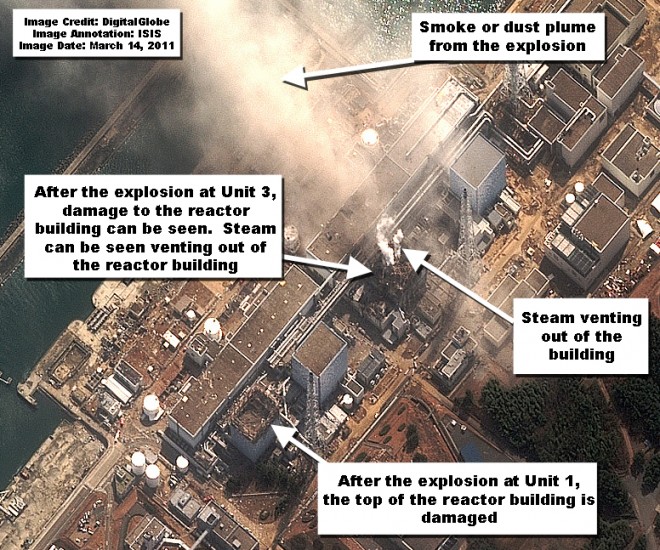

They also revealed that data recorded immediately after 11 March 2011 does not show any cooling problems, for at least 30 minutes after the 11 March quake/tsunami. A week ago TEPCo said reactor 1 began meltdown in the early hours of 12 March. Reactor 3 melted down on 13 March and reactor 2 on 15 March. I have to think that TEPCo’s instrumentation is faulty, or TEPCo officials are inept at reading the data collected, why else are they just now figuring this out?