Incomplete list (there’s just too much government BS to be able to keep up with all of it) of U.S. Federal/State/Local Government self-destruct announcements for September 2016:

Arkansas: July sales tax revenues for the cities of Fayetteville, Rogers, Springdale, Bentonville were up compared to July of 2015. There was no immediate explaination for the increase in tax revenues.

Arizona: Counties are begging the state goverment to raise gas taxes, threatening an increase in property taxes as an alternative. County leaders point out that since 2008 state administrators have used gas tax revenues for things other than road repairs!

California: Not only has Cupertino based Apple avoided paying its fair share of taxes to the not-so Golden State, as well as Taiwan, United States and European Union, but also failed to pay its fair share of taxes owed to Japan! Apple was apparently offshoring profits made in Japan to its tax haven operations in Ireland. Once caught Apple administrators quickly agreed to pay Japan $118-million USD in back-due taxes! Last month The Guardian reported that the Obama regime is threatening the European Union (an ally of the U.S.) for demanding U.S. companies like Apple pay their fair share in taxes!

Colorado: As everything else declines state and local tax revenues from marijuana sales continue to climb, but local news reports say desperate cities addicted to tax revenues are now fighting over how much of the state collections they’ll get, and how they can spend the money. For an example, the city of Edgewater claims they’ll make $1.2-million USD off the sale of marijuana!

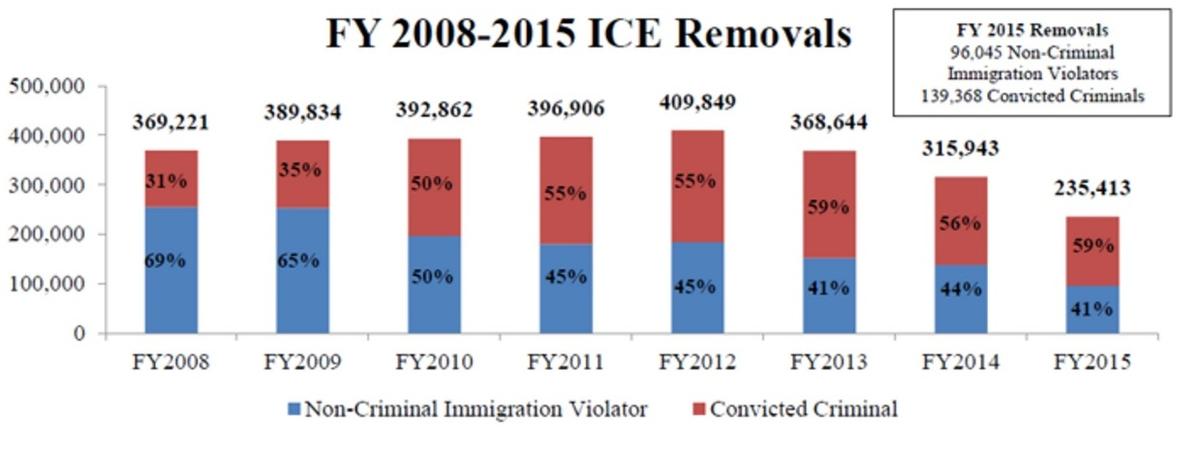

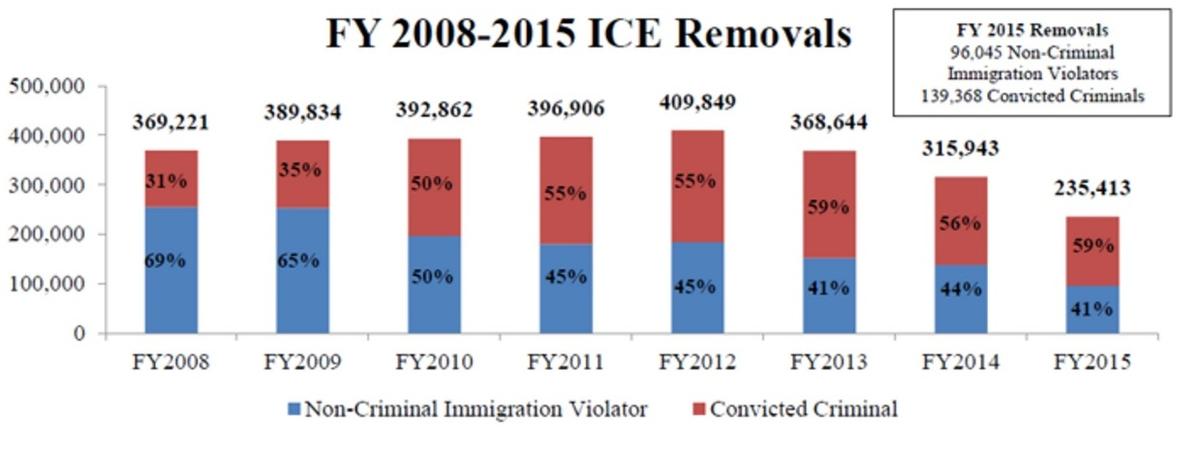

Idaho: The State Police will stop enforcing a booze law that allows them to crash establishments that serve alcohol during ‘live sex acts’. It’s the result of a lawsuit that proved that the law being used to harass bars with adult performers is too vague, and possibly unconstitutional. And the State Police are being sued for the 2013 killing of a Montana man. The man was questioned by police for 40 minutes before they shot him while he was sitting in the passenger’s seat of his car. Police claim the license plates didn’t match the man’s car and that there was a gun in the glove box. The family of the victim says police dash-cam video shows their son never threatened police with any gun.  Boise State Public Radio revelaed that the federal government refuses to reveal how many illegal immigrants in Idaho get deported. The U.S. Department of Homeland Security/Immigration and Customs Enforcement admitted that actual deportations have declined since 2012, due to a focus on immigrants convicted in court of crimes other than immigration violations. Here in Idaho deportations in 2015 dropped by about 4-hundred compared to 2011. And in Camas County, actor Bruce Willis‘ plans for a private airport crashed and burned after complaints from residents, and the city of Ketchum claimed it violated local laws. Apparently the land was zoned specifically for agricultural use.

Boise State Public Radio revelaed that the federal government refuses to reveal how many illegal immigrants in Idaho get deported. The U.S. Department of Homeland Security/Immigration and Customs Enforcement admitted that actual deportations have declined since 2012, due to a focus on immigrants convicted in court of crimes other than immigration violations. Here in Idaho deportations in 2015 dropped by about 4-hundred compared to 2011. And in Camas County, actor Bruce Willis‘ plans for a private airport crashed and burned after complaints from residents, and the city of Ketchum claimed it violated local laws. Apparently the land was zoned specifically for agricultural use.

Indiana: Dearborn County facing crashing riverboat gambling tax collections as analysts expect a 15% decline in the next two years. Local news reports say the county has been relying on casino taxes to support its budget and even with projected declines the casino tax still brings in the most revenue.

Louisiana: More proof of a Failed State; the Iberia Parish Sheriff’s Department eliminating 26 jobs, directly blaming crashing sales tax revenues.

Michigan: More proof of a Failed State; Montcalm County eliminating 20 jobs due to crashing tax revenues. Operating costs have outpace tax revenues by $2-million USD per year since 2012! Detroit Metropolitan Airport claims skyrocketing revenues from fees charged to airlines, to vendors and for parking. Thomas Naughton, CEO of the airport, credits “…increased demand and air service opportunities that have resulted in part by keeping our airline rates competitive…” Grand Rapids owned Indian Trails Golf Course threatening the city budget due to its $2.8-million income tax funded renovation. The problem is that optimistic city leaders expected almost $700-thousand from customer fees to help repay the renovation, which is now 50 days behind schedule.

Mississippi: The city of Jackson eliminating 28 jobs in an attempt to balance their budget. In Leake County, the troubled taxpayer funded Mormon corporate run Management and Training Corporation’s (MTC) Walnut Grove child prison shutdown after a lawsuit revealed years of sexual abuse, illicit drugs and physical abuse of child prisoners by corporate correctional officers.

Missouri: Kansas City reports a 58% increase in revenues due to its ‘special’ property and sales tax created to fund its new downtown public transportation streetcars. However, analysts point out that most of the increased revenues took place before the streetcar system went into operation and that the actuall economic impact of the new streetcar system is not yet knowable.

Nebraska: The Omaha Public Power District eliminating an ‘estimated’ 4-hundred jobs at the soon to be shutdown Fort Calhoun nuke plant!

New Mexico: The state Department of Tourism shutting down 50% of its visitor centers claiming its due to lack of use, but its really because the gov’na ordered a 5% reduction in spending.

Oklahoma: Oklahoma City revealed sales tax revenues continue to crash, and ordered more city government layoffs. The city needs to cut an additional $4.5-million USD. Reduced tax collections forced Comanche County to reduce next year’s budget by $204-thousand.

Pennsylvania: Local news reports say the city of Hazelton is short $813-thousand in tax collections, yet the mayor is asking for a 5% increase in spending so he can hire more people.

Tennessee: Evil Nashville based tax-sucking for profit prison company CCA (Corrections Corporation of America) laid off 55 HQ employees due to the federal government ending reliance on corporate run, yet still taxpayer funded, prisons.

Texas: Brown County reports that all cities within the county are suffering crashing sales tax revenues, for the fourth month in a row. However, some cities leaders swear their sales tax collections will be up for the year. The city of Plainview unanimously adopted a new budget that increased property values (a backdoor way of increasing property taxes) without hearing any public comment on the budget plan.

Virginia: City of Falls Church claims hard-to-believe tax revenues from a two months old mega-gorcery store/apartment complex combo, and that’s despite a sudden change of corporate ownership. The city council is crediting the new mega-gorcery store/apartment complex for helping create almost $500-thousand USD more than what was expected in fiscal year tax collections. The city of Fredericksburg claims an across the board increase in tax revenues. City leaders credit tourism for most of the tax revenue increases. Fairfax County wants to rape the tourists even more by proposing a 4% meal tax! Residents will vote on the proposal in November.

Washington: King County claims their local economy is strong, yet property tax revenues continue to go down. County leaders warn they must cut $22-million USD from next year’s budget, meaning jobs. Davis County wants to massively jack up property taxes for 2017. Leaders want an additional $7.2-million for county operations and $1.25-million for the county library system.

Washington DC: More proof of a Failed State; the Congress passed yet anther short term spending bill to avoid federal government shutdown. The new spending bill is good only until December, and will cost taxpayers trillions of U.S. dollars. Federal tax collector Internal Revenue Service (IRS) announced it must kill-off more than 7-thousand jobs between now and 2024, due to crashing hard copy filings of income tax ‘returns’! The massive layoffs will directly affect the states of California, Kentucky, Missouri, Texas and Utah.

Wisconsin: The ijiot ‘Right to Work’ you over gov-na Scott Walker is now so desperate to save his Failed State economy he’s proposing a sales tax holiday on school supply items. If the state cheese-weenie-head ‘lawmakers’ approve it it’ll go into effect in the 2017-19 school year.

WARN=Worker Adjustment & Retraining Notification

ISRAEL RAPES U.S. TAXPAYERS OF $38-BILLION IN NEW MILITARY FUNDING!

MORE U.S. TAXPAYER FUNDED MD-530 HELICOPTERS FOR AFGHANISTAN

FALSE FLAG: 15 YEARS LATER 9/11 BS CONTINUES, AT TAXPAYER EXPENSE!

End of Days? U.S. Forest Service and Department of Defense spend your taxes buying more firefighting planes, because they expect the wildfire season to get worse!

U.S. AFRICOM: FROM WAR ON TERROR TO WAR ON POACHING

August 2016: “EVERYTHING IS ON THE TABLE….NO ONE IS SAFE.”